How much can i borrow with deposit calculator

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else.

Need To Borrow Funds Know Which Loans Best Suits Your Needs Financial Aid For College World Finance Business Loans

Saving a bigger deposit.

. As a general rule the bigger the deposit you can save up compared to the loan you take out the more you will save in. That entitys obligations do not represent deposits or. How much deposit you need depends such things as.

What type of loan you want to take on. It will not impact your credit score and takes less than 10 minutes. Plus the bigger your deposit the smaller your loan.

See your borrowing power. 100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

100k deposit 500k assumed price 02 x100 for a percentage 20 deposit. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. How much you can afford to borrow.

Heres how a difference in your assumed property price and lender valuation can affect the deposit you need. Your salary will have a big impact on the amount you can borrow for a mortgage. If the same 320000 loan above has a 4 rate then you.

Our mortgage calculator can give you an idea of how much you might be able to borrow. These factors are taken into consideration when a mortgage lender calculates how much they could ideally lend you for a mortgage. What property you want to buy.

The amount you can borrow for your mortgage depends on a number of factors these include. Factors that impact affordability. You can calculate your mortgage qualification based on income purchase price or total monthly payment.

If you cant save enough some mortgages let you apply with a guarantor instead of a deposit. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. How our calculators can help Use our tools and calculators to work out what your home loan repayments could be estimate how much you could borrow the equity available in your home and much more.

Whether youre buying alone or with someone else. How much do houses cost. While your personal savings goals or spending habits can impact your.

The amount of interest youll pay to borrow the principal. A bigger deposit gives you more options and lower rates. Money you owe because of loans credit cards or other commitments.

Usually banks and. When it comes to calculating affordability your income debts and down payment are primary factors. You must consider the homes price the amount of your deposit and how much you can set aside for monthly mortgage payments.

If you save for a bit longer and have a bigger deposit we might be able to lend you more. Use our affordability calculator. The less you can borrow.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. You can then see the results of the different mortgages you can apply for. The amount you can provide as a deposit Your household income.

Offset mortgage vs savings. The size of your deposit will make a massive difference to the mortgage deal you can find. You can find out more about which mortgage is right for you with our mortgage guide or give us a call to talk to one of our mortgage experts.

What other fees and costs you will need to pay on top of your deposit. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

8 calculators to compare mortgages from ditching your fix to saving for a deposit. Remember it provides only an indication. The rate can be influenced by changes in the Reserve Bank of Australias official cash rate or the lenders own costs.

If you miss your mortgage payments your guarantor has to cover them. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. Find out how much you could borrow with our calculator.

An AIP is a personalised indication of how much you could borrow. Youll need to spend a little longer on this. Saving a significant amount takes time before you can afford a home.

Shows how long youd need to save for a deposit depending on the price of the property and percentage of its value you need to put down. Use this mortgage calculator to estimate how much house you can afford. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

First youll need to tell us the property value deposit and repayment term. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. How much can I borrow.

The interest rate on a variable rate home loan can change at any time either up or down. Market circumstances and competition between lenders can also lead to interest rate changes which can affect the interest rate of your loan. This mortgage calculator will show how much you can afford.

You can then find out how much you could borrow. As of December 2020 the. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you.

MBL any Macquarie entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 Cth. How much can I borrow. Your salary bill payments any additional outgoing payments including examples such as student loans or credit card bills.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Change the deposit you. Certificates of deposit CDs Mutual funds stocks and bonds.

You can also calculate your monthly repayments and interest rate.

Our Loan Services At Nityapushta Mutual Credit Repair Services Mortgage Loans Mortgage Loan Officer

Loan Calculator That Creates Date Accurate Payment Schedules

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

Are You Ready To Take Control Of Your Financial Life We Re Here To Help Financial Change Is All Interest Calculator Credit Card Interest Loan Interest Rates

Loan Calculator That Creates Date Accurate Payment Schedules

Pin On Loans And Loan Rates

Personal Loan Calculator Student Loan Hero

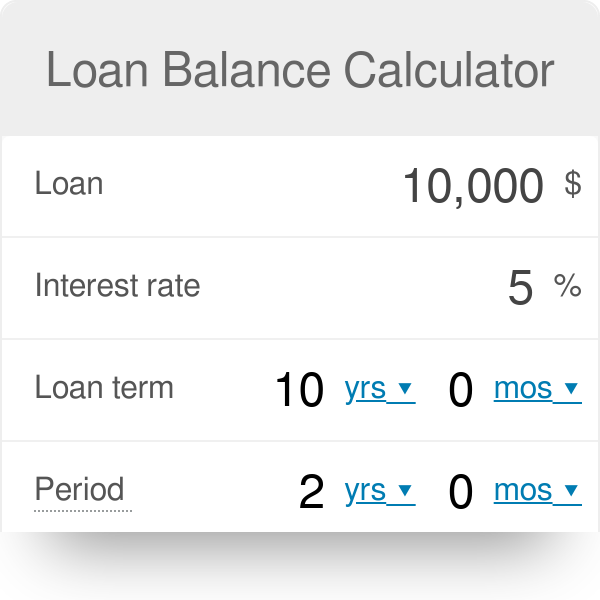

Loan Balance Calculator

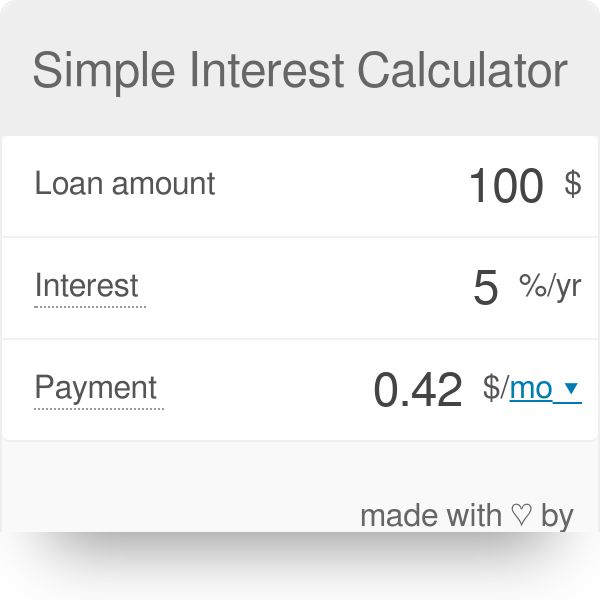

Simple Interest Calculator Defintion Formula

What Is Compound Interest And How Can You Make The Most Of It Me Bank Compound Interest Savings Calculator Simple Interest

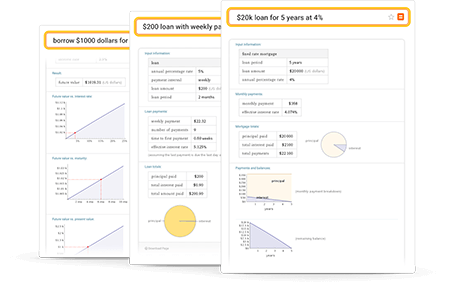

Advanced Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

Loan Calculator Wolfram Alpha

Financial Loan Calculator Estimate Your Monthly Payments

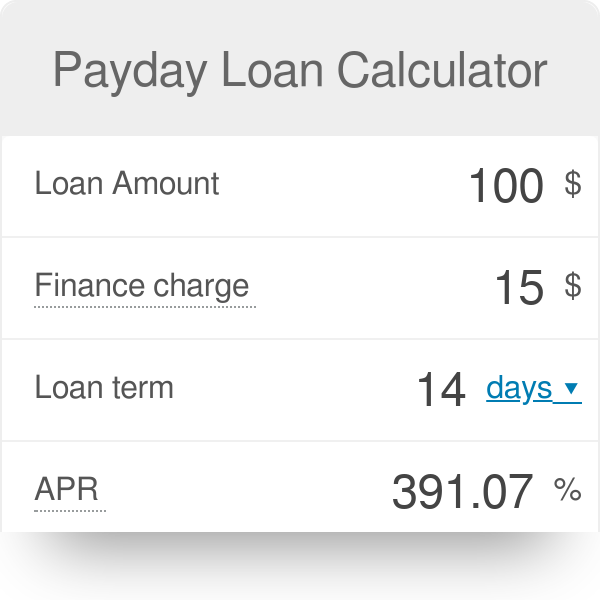

Payday Loan Calculator

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Personal Loan Calculator See Payments Get Offers