Stock option tax calculator

The Stock Option Plan specifies the total number of shares in the option pool. Employee Stock Option Calculator for Startups Established Companies.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

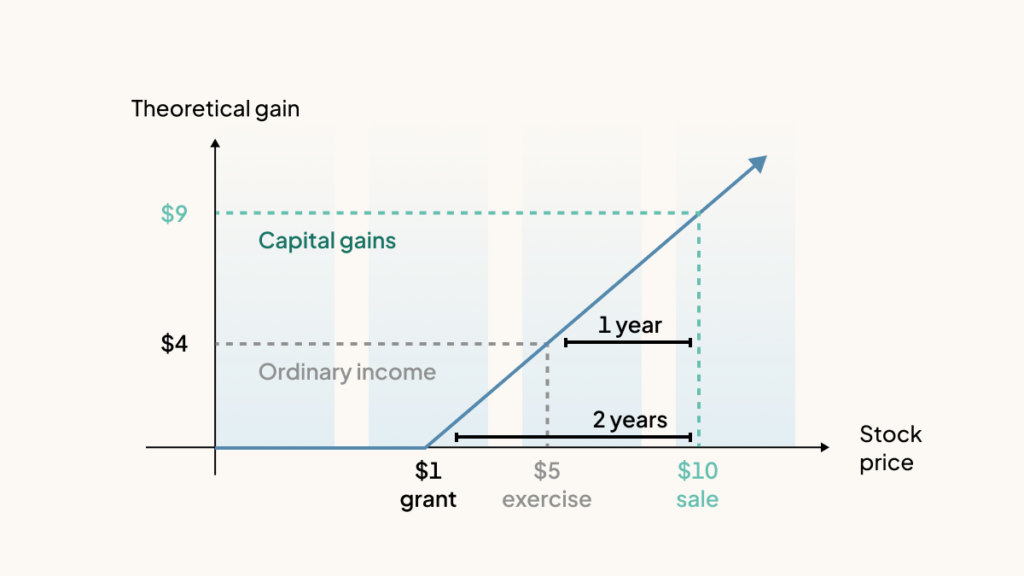

Ordinary income tax and capital gains tax.

. The complete guide to employee stock option taxes. Ad Manage volatility w a tool that directly tracks the vol market. Open an Account Now.

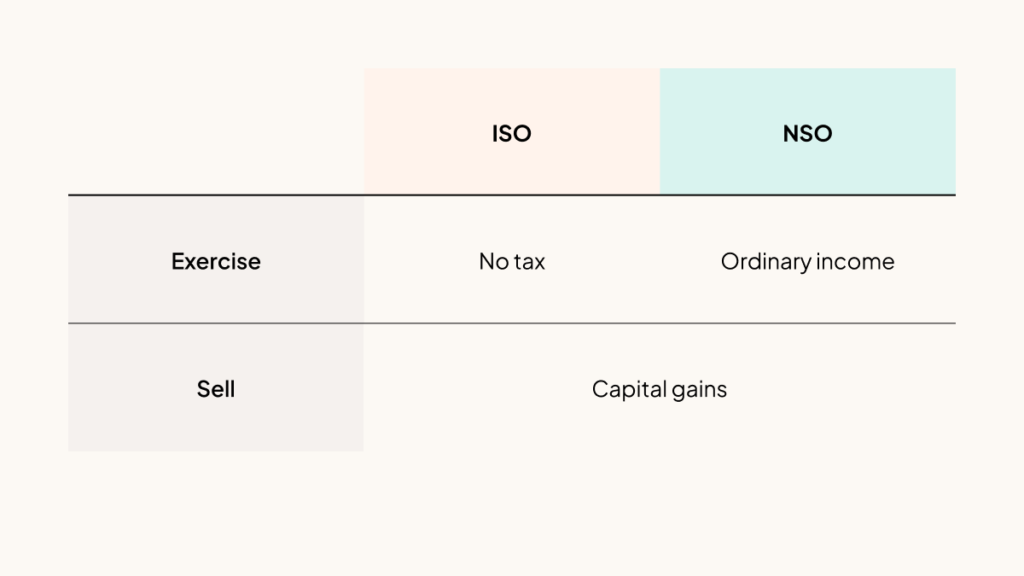

Section 1256 options are always taxed as follows. If youre a startup employee earning stock options its important to understand how your stock. There are two types of taxes you need to keep in mind when exercising options.

The tool will estimate how much tax youll pay plus your total return on your. On this page is a non-qualified stock option or NSO calculator. Cash Secured Put calculator addedCSP Calculator.

Heres a real-life example. Ad Were all about helping you get more from your money. Click to follow the link and save it to your Favorites so.

In our continuing example your theoretical gain is. Our Stock Option Tax Calculator automatically accounts for it. January 29 2022.

Stock Option Tax Calculator. Nonqualified Stock Option NSO Tax Calculator. The following calculator enables workers to see what their stock options are likely to be valued at for a range.

Exercise incentive stock options without paying the alternative minimum tax. On this page is a non-qualified stock option or NSO calculator. 60 of the gain or loss is taxed at the long-term capital tax rates.

Nonqualified Stock Options NSOs are common at both start-ups and well established companies. Web-based platforms to quickly analyze options trading activity and identify opportunities. The amount depends on your tax situation for the year.

In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income. Understanding Your Stock Option Benefits.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Please enter your option information below to see your potential savings. How much are your stock options worth.

Ad A range of options trade data alerts and visualizations a single web-based tool. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. The calculator is very useful in evaluating the tax implications of a NSO.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Lets get started today. On this page is an Incentive Stock Options or ISO calculator.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Calculate the costs to exercise your stock options - including taxes. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Web-based platforms to quickly analyze options trading activity and identify opportunities. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained. Short-term and long-term capital gains tax.

While if you hold that property or stock. VIX options and futures. Ad A range of options trade data alerts and visualizations a single web-based tool.

This permalink creates a unique url for this online calculator with your saved information. New Hampshire doesnt tax income but does tax dividends and interest. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Poor Mans Covered Call calculator addedPMCC Calculator.

40 of the gain or loss is taxed at the short-term capital tax. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Find the best spreads and short options Our Option Finder tool.

Say in total you have 15000.

Understanding How The Stock Options Tax Works Smartasset

Federal Income Tax Calculator Atlantic Union Bank

Capital Gains Tax What Is It When Do You Pay It

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

How Stock Options Are Taxed Carta

Cost Of Debt Kd Formula And Calculator Excel Template

Understanding How The Stock Options Tax Works Smartasset

How Stock Options Are Taxed Carta

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

How Stock Options Are Taxed Carta

Employee Stock Options Esos A Complete Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Calculating Diluted Earnings Per Share

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Options Esos A Complete Guide

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

/employeestockoption_definition_final_0817-372c2669a3a54015a7bfa4eb6e884649.png)

Cijvp1txl9 Qsm

Employee Stock Options Financial Edge